Select A Time & Fill Out Survey Below👇

Secure your Legacy with IUL

An "IUL" is a super-charged safety net. It's an interest-bearing account with steady compound financial growth... without risking your principal to a bad market. 🛡️

Unlock the secrets wealthy individuals have used for over 40+ years: harnessing cash value life insurance to grow your wealth and minimize your tax bill— legally!

Protect your retirement and family’s financial future against unforeseen circumstances.

The death benefit is generally the LAST thing you should be worried about within the policy; IUL's benefits are tailored for the LIVING.

An Indexed Universal Life policy will provide financial stability- helping with:

✅ Saving for a more comfortable Retirement

✅ Liquid Income for future investments

✅ Compound Interest on your money

✅ Loss of income due to Critical, Chronic, or Terminal Illness

✅ Daily living costs in your absence, etc.

Simply put- it's "Peace of Mind" for you, & "Protection" for them. 🌟

Top Benefits of an IUL

(Indexed Universal Life)

Cash Value Growth for Retirement

Your cash value can grow based on the performance of stock market indices (4 - 8 % annually), offering the potential for higher returns. Unlike traditional savings accounts, this growth can significantly increase your savings over time.

Wealth Transfer Benefits

IULs are an effective tool for transferring wealth to your heirs. The death benefit can provide financial security for your family, ensuring they have resources to cover expenses or continue their lifestyle.

Tax Advantages

The cash value growth in an IUL is tax-deferred, meaning you will make tax-advantaged earnings as it accumulates. Additionally, your beneficiaries receive the death benefit tax-free, maximizing their financial support.

Downside Protection

IULs come with a “floor” that protects your cash value from market losses, typically set at 0%. This means that even in a market downturn (like in 2008 & 2020), your investment won’t decrease in value.

Borrow From Yourself

You can borrow against your policy’s cash value without penalty, giving you access to funds when needed. Use your policy to invest in your future endeavors (while your money is still growing Compound Interest!)

Flexible Premiums

IULs allow you to adjust your premium payments to fit your financial situation. This flexibility helps you manage your policy according to your changing needs and goals.

Chronic Disability Income

Long-term health conditions; need help with at least 2 out of 6 daily functions:

Bathing: bathe oneself independently.

Dressing: dress and without assistance.

Eating: The ability to feed oneself.

Transferring: The ability to move from one place to another.

Toileting: Using the toilet independently.

Continence: The ability to control bladder and bowel functions.

Power of Compound Interest

You earn interest on both your initial investment (principle) and the interest that accumulates over time. This powerful feature can significantly boost your cash value, allowing your savings to grow faster and providing you with greater financial resources for the future.

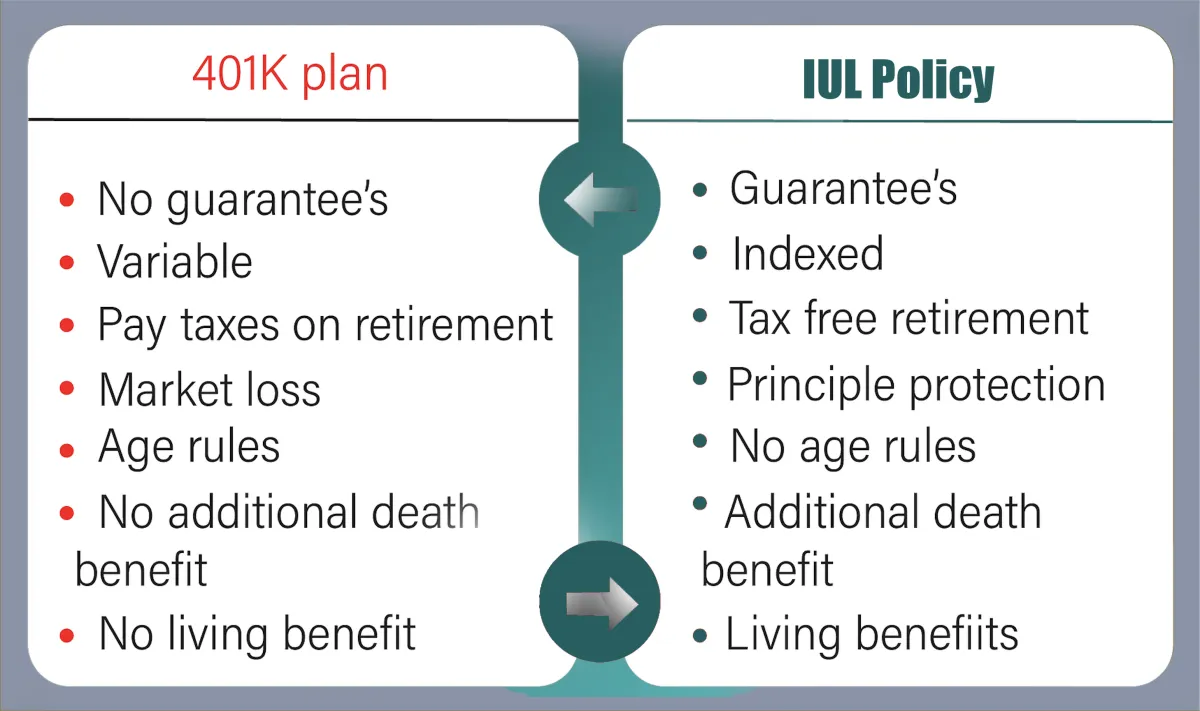

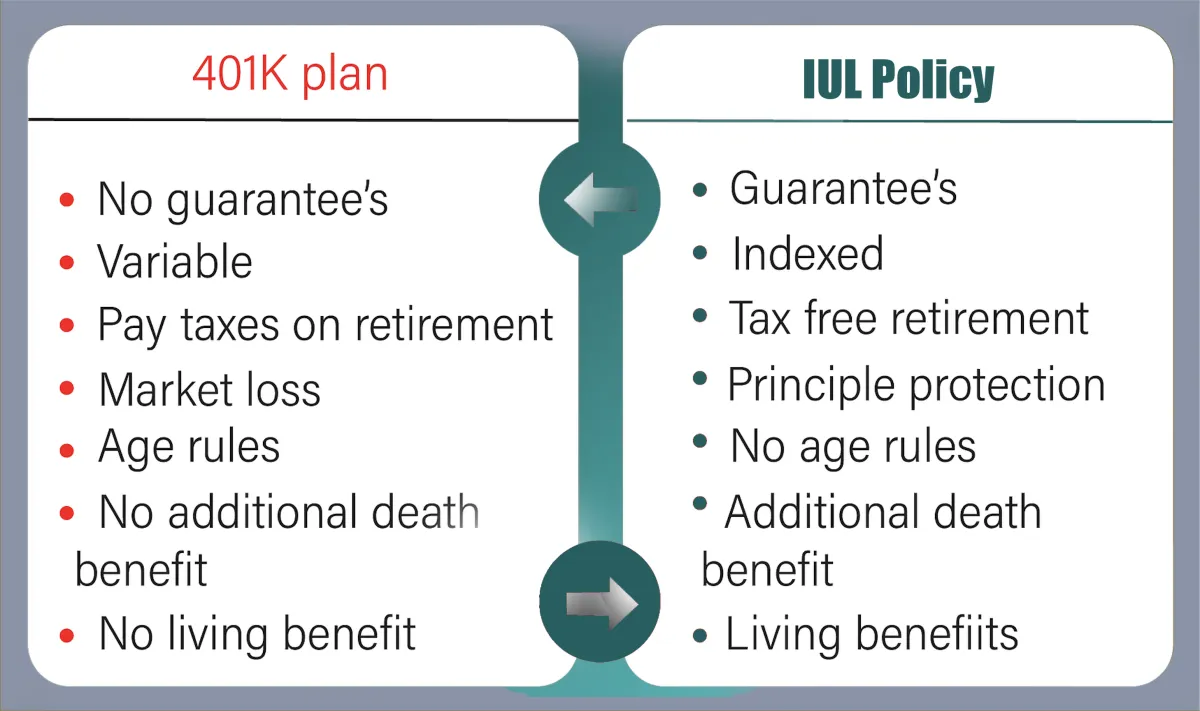

Way better than a 401K

(IUL) policy provides flexible contributions and tax-free access to cash value, allowing for penalty-free withdrawals before retirement. Unlike a 401(k), an IUL offers growth potential without market risk and includes a death benefit for added financial protection.

Ready to get started?

Our A+ Rated Carriers:

& Many More! Over 35+ Carriers to Choose From!

Simple 3-Step Process:

1) Get a Quote Over the Phone or Zoom

Click “Quote Button” to fill out the 2-minute Life & Health Survey & choose a time to chat.

Your personal underwriter concierge will give you a call during your selected time.

2) Select Your Policy & Apply

Shop 35+ carriers for the best policy options based on your Age, Health, and Budget. Policy Application takes 7 minutes to complete over the phone!

3) Lock-in Coverage! 🛡️🥳

Get pre-approved 100% over the phone! In most cases, NO medical exams are required! IUL polices take anywhere from 1-3 weeks for approval (Depending on health status).

TESTIMONIALS

Client

Yolanda C.

Indexed Universal Life (Arizona)

As a single mother, my top priority has always been providing for my children’s future. When I discovered Indexed Universal Life (IUL) insurance, I knew it was the perfect solution. Not only did it give me a solid life insurance policy to protect my family, but it also allowed me to accumulate cash value over time.

Knowing I have this financial safety net gives me peace of mind, and I feel confident that I’m setting them up for a bright future. I couldn’t be happier with my decision to invest in an IUL!"

Kenneth J.

Indexed Universal Life (Nebraska)

I see commercials about IULs on Facebook almost every day, but I reached out to my insurance Legacy because they resonated with me the most.

It's time to get serious about my retirement. There are better strategies out there than just pumping money into a 401(k).

What I love best about this policy is the compound interest money over the years.

I'm ready to finally have my money start working for me, and not the banks."

It Only Takes 15 Minutes To Change Your Legacy...

FOREVER.

Use an IUL to Super-Charge Your Retirement.

It's time to take action. Here are the most Frequently Asked IUL Questions: 👇

FAQ 1):Is a IUL policy a good choice for me??

Indexed Universal Life products designed to provide permanent life insurance protection and access to tax-deferred cash values. The ideal candidate for a max-funded Indexed Universal Life (IUL) insurance policy typically includes the following characteristics:

✓ High Earners: Individuals with a higher income who can afford to maximize their premium contributions will benefit most from the cash value growth potential.

✓ Long-Term Financial Goals: Those focused on long-term wealth accumulation and retirement planning can leverage the tax-deferred growth of cash value over time.

✓ Risk-Averse Investors: People who want market exposure without the risk of losing principal may appreciate the downside protection that an IUL offers.

✓ Estate Planning Needs: Individuals looking to leave a tax-free inheritance or provide for beneficiaries can find IULs a strategic part of their estate planning.

✓ Tax-Conscious Investors: Those seeking ways to minimize tax liabilities during retirement will find the tax-deferred growth and potential tax-free withdrawals attractive.

✓ Business Owners: Entrepreneurs looking for supplemental retirement plans or a way to fund buy-sell agreements can benefit from the features of an IUL.

✓ Health-Conscious Individuals: Healthy individuals who can qualify for favorable underwriting rates will get the best value from an IUL policy.

✓ Financially Savvy Individuals: Those who understand the importance of life insurance as a financial tool rather than just a safety net are ideal candidates.

✓ Parents Planning for Education: Parents wanting to build a savings vehicle for their children's education can use the cash value for future funding needs.

FAQ 2) Do I have to draw blood or urine?

🚫💉No blood / NO Medical exams required

All of our policies up to $1 million are non-medical. This means we can see if you get approved based off of your medical information Bureau history.

Everything is done electronic; they will pull your exact health history to see which tier you qualify for.

FAQ 3) How much should I put in to start my policy?

On average, most people kick things off with just $300! (For max-funding to work to your favor).

But for our clients who want to supercharge their cash growth, starting with $1,000 or more is the way to go! 🚀 The more you invest, the faster your policy can grow!

FAQ 4) Do I have to meet in-person??

☎️ Get Approved DIRECTLY over the Phone, ZOOM, or Facetime!

Insurance agents used to have to go to your house, however, COVID-19 changed the game. It only takes 10 to 15 minutes to get approved directly over the phone!

If you are healthy enough, there is a great chance you will receive your policy number same day!

FAQ 5) What are the Advantages of having an IUL? 🤨

Super Safe: Your cash value isn’t tied to the stock market, so you can relax knowing your money is protected!

Great Growth: You can earn interest between 5% and 10% each year, depending on how well the index performs. That’s pretty cool!Tax-Free Fun: Any interest you earn is totally tax-free! More money in your pocket!

💰Easy Access: Need cash? You can take out money from your IUL anytime without any penalties—no matter how old you are!

Retirement Boost: If you set it up right, your IUL can give you tax-free income during retirement. How neat is that?

Support When You Need It: If you get seriously ill, you can access 80-100% of your death benefit. It’s there to help you!Forever Benefit: The death benefit lasts forever!

Plus, it’s not taxed and skips the probate process.Put in as Much as You Want: There are no limits on how much you can add to your IUL. More contributions mean more growth! 🌱

FAQ 6) Does my Beneficiary have to pay taxes on the money?

NO. 😁

Your policy is a 100%Tax-Free Benefit.

Beneficiary gets the scheduled death benefit amount, minus any loans and outstanding interest on loans.

FAQ 7) What are the unfavorable traits to an IUL?

It can take several years for the cash value to grow, depending on how the policy is funded.

Second, the cost of insurance may be higher based on your age and health.

Lastly, there may be years when the index doesn’t perform well (Like in 2008 and 2020), resulting in no interest earned for that year.

In such cases, your cash value will remain the same—neither gaining nor losing any amount.

FAQ 8) How soon can I access the funds in my cash value?

Typically, it takes about 5 to 10 years to build up enough funds for a withdrawal, with a minimum withdrawal / loan amount of $500.

However, if you fully fund your policy to the MEC limit, you can access your cash value after just 12 months!

FAQ 9) I have pre-existing conditions, can I still qualify?

Typically, most mild cases (like well-controlled High Blood Pressure) will still get approved.

Here is a list of KNOCKOUTS (Will not qualify):

-A felony within 5-10 years

-Currently on probation

-DWI or DUI within 5 years

-Overweight (Depends on height)

-Personal history of cancer

-History of alcohol or substance abuse

-Life, health, or disability insurance that has been rated or declined

-Major medical conditions

-Alcohol Abuse

Let's Find a Time to Talk!

Policy Request Takes 10-15 minutes for Approval.

Most get approved same-day! 👇👇

Peace and Love. We are looking forward to helping you soon.

By clicking the submit button, I expressly consent by electronic signature to receive communications via automatic telephone dialing system or by artificial/pre-recorded message, AI voice/ Robot Voice, email, voicemail drops, or by text message from this website and multiple partner companies or their agents at the telephone number above (even if my number is currently listed on any state, federal, local, or corporate Do Not Call list) including my wireless number if provided. Carrier message and data rates may apply. I understand that my consent is not required as a condition of purchasing any goods or services and that I may revoke my consent at any time. I also acknowledge that I have read and agree to the Privacy Policy and Terms & Conditions below.